CT (Custom Taxes) Number become TIN (Tax Identification Number)

On January 1, 2020, a new Tax Administration ACT (TAA) entered into force.

As a result of this new law, the CT (Custom Taxes) number becomes the TIN (Tax Identification Number).

This year 2020-2021 is considered by the Inland Revenue Office as a year of transition.

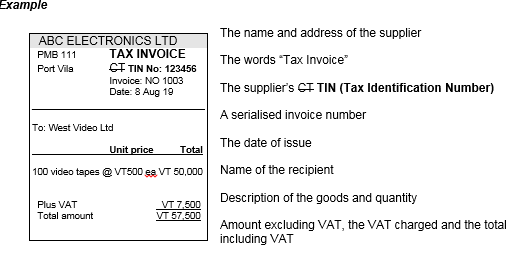

The taxpayers are required to change their receipts or tax invoice to indicate TIN on the document where it must appear to replace CT. The tax administration office gives until the end of the year to comply with this change.

From 1 January 2021, if a taxpayer does not include the word TIN on their receipts or invoices, they could be penalised by the Inland Revenue Office.

The Tax Administration ACT (TAA) entered into force on January 1, 2020. This law introduces a series of new measures, of which three major changes can be identified:

- Penalties and interest on late payments AND late returns.

- An obligation for companies to use tax identification numbers (TIN).

- Record keeping requirements for businesses.

For more information on the TAA, you can consult the following Daily Post article: Gov’t To Consult On New Tax Law.

Or download the Tax Administration ACT (TAA)

If you have any questions about the changes to be made or the TAA, contact us:

Find us on: